If you want to know if Seedify Fund is a good investment and don’t want to waste hours doing research about it, you are at the best place. We made this website for the only purpose of answering this question, as we have the same issue and want to help people to see all the data and information without spending hours as we did.

So, if you want the quick answer, after doing the numbers, YES, it can be a good investment. But we are talking about using your Seedify Fund tokens to participate in IGOs, not just hold the token. If you are familiar on what it is Seedify Fund, and just want to see the numbers for your case, just check our Seedify ROI Calculator.

If you’re not familiar with IGOs, you can still open the Calculator. It will be useful once you understand how Initial Game Offerings (IGOs) work, as well as the role of the Seedify Fund (SFUND) token. IGOs, or Initial Game Offerings, are the launches of new project tokens before they become publicly available for purchase. Typically, the price of tokens during an IGO is lower than their price at public launch. This allows you to buy tokens of promising projects before they hit the market. Moreover, it is in the best interest of the Seedify Fund team to exclusively launch projects that are exceptional, backed by competent teams, and have promising projections. If they were to launch bad projects, it would discourage people from participating in the IGOs and lead to them selling their SFUND tokens.

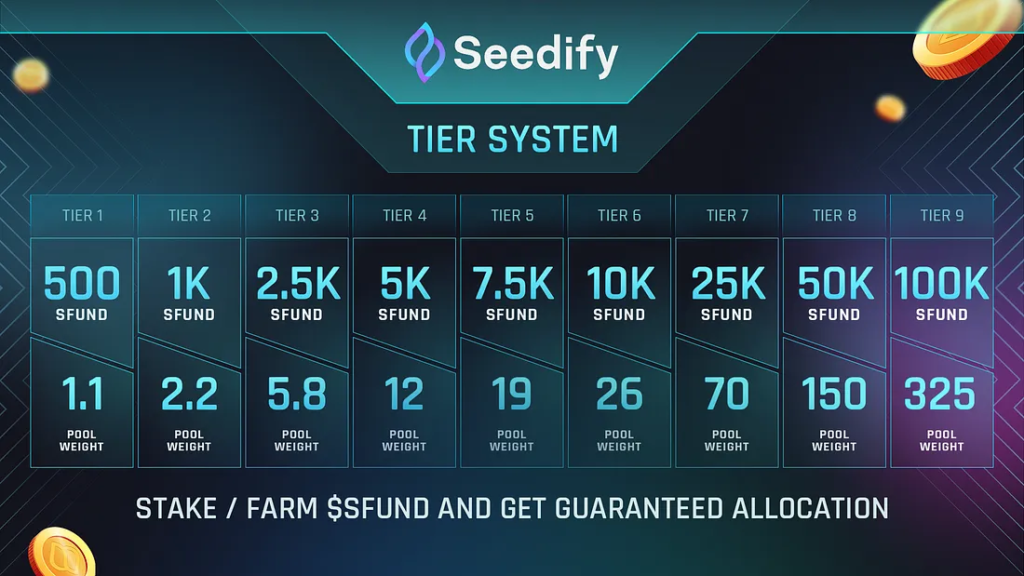

So, you might now be curious about the purpose of the SFUND token. It’s quite straightforward. To participate in the IGOs, you need to hold a minimum amount of SFUND and stake it on their platform. Now the minimum is 500 SFUND, but this can vary. The greater your SFUND holdings, the larger the amount you can invest in each IGO launched on Seedify Fund. It’s that simple.

So, SFUND stands out as a particularly good investment because, unlike other crypto projects, you can still profit even if the token’s value decreases. Your potential earnings aren’t solely dependent on the token’s appreciation. You can realize significant gains from participating in IGO launches, without the need to sell your SFUND tokens, and this holds true even if you end up selling the tokens at a loss.

Now that you know what IGOs are, you can check the average profit achieved in Seedify Fund by clicking the button below. This will also show you how long it would take to earn back the same amount you invested in SFUND for participating in these IGOs.

Risks

Now that you know how it works, we prefer to first discuss the risks before delving into potential catalysts. We don’t want to leave this until the end and risk you not being aware of them. So, let’s go through them.

- Inability to participate in IGOs. Due to regulatory issues, there are countries like the United States and others where participation is not possible, as it requires KYC in addition to owning SFUND tokens. You can still benefit if the SFUND token increases in value, but you won’t be able to participate in IGOs if you reside in one of these countries. However, if this is your situation, contact us to find a possible solution. Check all the list here.

- Downtrend in gaming projects in the crypto industry. Seedify Fund has positioned itself as a launchpad for gaming projects, so it is closely tied to whether this trend continues to rise and if there is future projection by investors in these types of projects. Otherwise, valuations and launches may perform poorly.

- Limited allocation of funds in each IGO. This can be observed using the calculator, but realistically, you need to participate in many IGOs to recoup the same amount you invested in SFUND. Although SFUND is not money that you lose, as you can always withdraw and sell the tokens, it is money that is locked up for participating in the IGOs, and therefore cannot be sold if you want to continue participating. So, if you buy SFUND at or near its highest price, it will be difficult to make a short-term profit if its price does not rise again.

- High entry barrier. Currently, the minimum is 500 SFUND, so it will depend on the price at the time of reading this, but it is usually a significant amount for many people. With fewer tokens, you can only hope for its price to increase, without participating in IGOs, which is where the greatest potential profit lies. Additionally, sometimes when many users have 500 SFUND, the allocation is not 100% guaranteed, and it is done through a lottery format. Therefore, in times of high interest in participating in IGOs, to ensure 100% participation, you should have at least 1,000 SFUND staked.

Catalysts

Let’s move on to the part you’ve probably been eagerly anticipating: the factors that could cause the price of SFUND to soar again. So, let’s dive in.

- Far from its All-Time High: Looking at its highest price achieved in the last bull run, we see that it’s still far from approaching that level. Having maintained quality and users during the bear market, it’s possible that with continued successful launches, we might see SFUND reach new highs in the future.

- Diversification into NFTs: In addition to IGOs, one aspect we haven’t discussed but have been implementing for some time is the same concept but with NFTs. Thus, users who have SFUND staked will also be able to participate in launches of NFT collections, thereby extracting greater value and returns from their staked SFUND. However, NFTs are often linked to gaming and it’s not so common to launch a collection on launchpads, as they are usually released individually. Hence, they might not have as much potential or yield big benefits like IGOs.

- More allocation with more SFUND staked/farmed: As might seem logical, but not always the case in many projects or formats, if you have a larger amount of SFUND, the allocation in proportion to the amount invested is higher. This means if you have 500 SFUND, you might invest 1%, while with 5,000 SFUND, you could invest 3% in each IGO. These figures are just examples to illustrate the point. You can see detailed information on this in the calculator. This increases the demand to buy SFUND and to have more tokens staked.

- A great project changes everything: In the past, we’ve seen how a well-known project generates a lot of interest in Seedify Fund and attracts many investors. Therefore, a single highly successful project can cause its price to skyrocket, as happened in the previous bull run with Bloktopia, for instance. The best way to attract users is to make money for your users, as was the case here. With a peak profitability of 71,212.40%, it drew the attention of many users.

- Not listed on major exchanges: SFUND is currently not listed on major exchanges like Binance and Coinbase. Listings on these platforms often attract new investors who primarily use these well-known platforms.